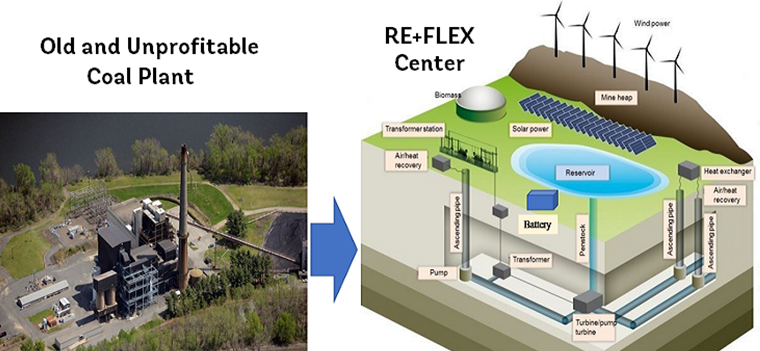

Photo caption: Mount Tom coal plant (on the left panel) in Massachusetts was one of the worst polluting plants in the USA that closed in Dec 2014 ("A Solar Farm Rises From the Ashes of a Coal-Burning Power Plant"). The site was used to develop a solar farm. On the right panel, we show the vision of a RE+FLEX centers that can combine not just solar but other RE resources and battery/pumped storage. The image in fact is from the Prosper-Haniel coal mine in Germany that is being converted into a 200 MW pumped-storage hydro.

The Existential Threat to the Coal Industry

Coal power unit retirement is hardly new. In the last 50 years, a vast number of smaller, older, and less efficient units have been retired in most power plants globally. However, the majority have been replaced by larger, more efficient generators. As a result, global coal generation increased from ~6000 TWh to ~10,000 TWh over 2000-2015, and global coal production has increased from 4.6 billion tons to 7.3 billion tons over the same period.

Coal generation is widely believed to have peaked around 2014/15, then stabilized. The global average utilization of coal plants has dropped from the peak of 66% in 2015, down to 51% in 2016 (Waller, 2018) which has strengthened the buzz around stranded capacity and rapid retirement of coal power generating assets. The recent RMI report 'Managing the Coal Capital Transition' (Waller, 2018) posits an accelerated phase out of more than 1,200 GW of coal worldwide over the next 30 years.

Figure 1: Phasing Out of Coal: Natural phase out and "hard" deadlines (in red) of 2 TW of coal

Source: CoalSwarm analysis

It appears that the "natural" phase out of coal is going to be a reasonably fast-paced process for three reasons.

- There is a large aging population of coal plants. In USA alone, around 50 GW of the coal retired over 2000-2015 was on average 54 years old, compared to a standard life of 25 years. Further, there are an additional 350 GW operating that are more than 40 years old (Raimi, 2017).

- Although the popularity of coal stemmed from its distinct cost advantage over other resources, a sharp decline in renewable energy generation costs means it is fast losing its competitive edge. A Carbon Tracker estimate published in November 2018 suggests that 42% of the coal plants globally are already making a loss, and this share will rise to 56% by 2030 and 72% by 2040 (Fig. 2). The value of stranded assets has been estimated at $255 billion by 2030.

- The process of phasing out coal generation assets may be irreversible, unless there is a major technological breakthrough in carbon capture which would sustain the coal power generation industry.

As with any prediction, it is hard to be definitive about the precise timeline and quantity of fossil-fuel based generation asset phase-out. Recent reports using satellite imagery questioned China's commitment to closing large parts of their coal fleet. Nevertheless, the general trend of stabilizing/declining coal-based generation that has emerged in the last five years (Figure 1) appears likely to continue. Within this trend, it is unlikely that the 40-plus-year-old units in the U.S. will be replaced with other coal units, although there might be some level of fuel switching to gas.

Note that the purpose of this note is not to focus on the prediction of the retirement pace. Instead, the inevitability of coal plant retirement will provide an opportunity for increased renewables uptake, energy storage, and old plant component repurposing for grid stability applications.

Figure 2: Profitability of Coal

Source: Carbon Tracker portal that covers 6,685 coal units around the world

There is a problematic set of underlying social issues linked to coal plant retirement, mostly linking back to coal mine closure issues. The recently published World Bank report Managing Coal Mine Closure: Achieving a Just Transition for All illustrates nine key lessons that center around the main theme: “Given the energy transition, planning and preparing for coal mine closure are essential to lessen the shock to coal-dependent communities and facilitate new employment possibilities for redundant workers”. (World Bank, 2018). One of these lessons is particularly noteworthy in the context of our discussion: “A systematic process to mitigate social and labor impacts that starts before any labor layoffs occur can result in a more orderly, less stressful, and ultimately lower cost divestiture process.” A well-planned re-purposing of coal plants and associated coal mines could hold the key in softening the social impact, partially reducing the opposition to coal plant/mine closure.

A Renewable Rebirth?

The potential demise of coal leaves the energy community with a new set of questions: what do we do with these sites, with parts of the infrastructure and machinery, human resources, ancillary industries, and communities? Raimi (2017) looked at a sample of 28 coal plants in the U.S. that were retired over 2000-2016 and estimated the average cost of decommissioning at $117,000/MW (with a range of $21,000-$466,000/MW). This is almost eight times higher than the cost for retiring gas plants in USA. If we were to extend the coal decommissioning cost to the 2 TW figure previously cited, the cost of such closure could add $234 billion—on top of a stranded asset value of $255 billion.

Often, literature on coal plant closures does not broach the topic of re-purposing sites. The message from Waller (2018) suggests an exit strategy without prolonging the pain, e.g., "By taking the initiative and thinking creatively about balance sheets and asset management strategies, owners might craft an appealing exit strategy that is superior to losing an adversarial regulatory battle." That said, numerous proposals by President Obama suggested redirection strategies for coal-dominated communities, including retraining miners.

Re-purposing coal plant sites would reduce decommissioning costs, while reducing the cost of new power options added to the site.

Coal plant sites, their connections to power grids, water, and transportation, and the associated human resources have significant value. Re-purposing sites for alternative use should be feasible beyond fuel switching from coal to gas/LNG, which is also likely to occur. It is not surprising to find that there is a positive image slowly emerging from new and innovative ways of using retired coal plants.

- Google announced in 2015 that "it would open its 14th data centre inside the grounds of [an] old coal plant, and had reached a deal with the Tennessee Valley Authority, the region's power company, to supply the project with renewable sources of electricity". This project commenced construction in April 2018.

- An Australian coal-fired power plant in Hunter Valley, New South Wales is also to be repurposed to supply electricity below grid cost to blockchain companies in the region. The IOT Blockchain Application Centre (BAC) plant is expected to start operations in 2019 and may use a mix of biomass and solar panels for generation.

- In India, there has been a recent announcement that the ash disposal site of the recently closed Guru Nanak Dev Thermal Plant will be repurposed to develop a 100 MW solar plant. Furthermore, NTPC is soliciting bids to install floating PV plants on the cooling water ponds.

- Australia is likely to see a rapid reduction in its coal fleet and has been considering the use of battery, gas and renewables to replace existing Liddell plant site in 2022 among other coal plants. "Repurposing the site to offer high quality jobs for decades to come" has been cited as one of the main reasons for such an initiative.

- In Canada, the Nanticoke coal plant (4 GW) site will be used for a small (44 MW or ~1% of the original coal capacity) solar farm. This was announced in 2016 and the construction of the solar farm began in 2018. The discussions following the announcement in 2016 evoked a mixed reaction to the small size of the solar farm, a significantly higher cost of electricity from the solar farm at the time, and the limited job opportunities that it offered.

- The US has seen a few cases of old coal fired power stations turning into solar farms. The Mount Tom power station in New England, one of the worst polluters in the region, now has a small 5.7 MW solar farm developed over a 22-acre area in the old plant site. However, Raimi (2017) among others have noted that many plants that are not sitting on attractive real estate tend to sit "cold and dark".

- Germany has a plan to turn an existing coal mine in Prosper-Haniel into a 200 MW pumped-storage plant in 2019 once the mine mouth power plant shuts down.

- The use of a retired coal plant to provide frequency control services where there is a good market for such products has been used in the US for many years. For example, Duke Energy placed a storage system at the retired coal plant in New Richmond, Ohio to leverage the available transmission capacity at the site. It provided ancillary services in PJM's frequency regulation market that created a new revenue stream.

- The Eastlake plant in Cleveland, Ohio is another fine example of converting an old coal plant into a giant synchronous condenser capable of producing fast reactive power critical for prevention of voltage collapse in the system following a large contingency, such as the loss of a large source of RE generation or a line. It will also generate real power if needed, moderating the drop in AC frequency that could result from a sudden loss of wind/solar. This is probably going to be an oft-repeated application of large old coal units as they have traditionally provided the dynamic reactive power and inertia to the rest of the system. Eastlake, Slattery and Fogarty (2015) noted that "Cleveland, Ohio still required dynamic voltage support, so various options were considered. The synchronous condenser conversion was selected in view of the static and dynamic voltage support it provides, as well as advantages of the installed infrastructure at the Eastlake plant". There have been similar conversions in California and Germany since then.

- Finally, CDC, a North American commercial real estate and brownfield redevelopment company, has announced plans to acquire the site of the Brayton Point power station from Dynegy and use it for offshore wind energy. CDC said the site "represents a unique opportunity to advance the offshore wind energy sector due to its pre-existing access to the regional transmission grid. The site is also close to proposed development areas for offshore wind, has potential as a deep-water port and access to a highly skilled workforce in the New England area".

While these developments are undoubtedly positive, we must admit that as of now, this list is grounded more on anecdotes and good old Googling. The number of coal MWs that have been repurposed to date is a very tiny fraction of the coal capacity. There is also no comprehensive survey of the industry practices on re-purposing to the best of our knowledge. Nevertheless, we felt that this patchy image is worth looking at to create some awareness of these possibilities, given the transformative potential it holds.

We should consider whether there is a comprehensive packaging of various options to develop RE+FLEX centers. However, we must recognize some of the constraints that have emerged, including the fact that a RE+FLEX center would likely replace only a small fraction of the energy that the incumbent coal project delivered. Such a criticism was leveled against the Nanticoke plant in Canada. Further significant challenges would be the ability to retrain and reabsorb the coal workforce, and the means of converting plants in remote locations.

Designing a Technical Assistance to Articulate a System-wide Strategy and Identify Good Projects for Repurposing

A massive amount of coal capacity is expected to be stranded and possibly retired. CarbonTracker noted those highest at risk are in China and India. A "renewable rebirth" is possible based on some anecdotal evidence. A more thorough mapping of the investment, policy, and regulatory means to bolster this pathway is now required in tandem with the relevant workstreams around energy transformation, Powering Past Coal, and mine closure.

A second task would be to come up with a suite of engineering designs that can be replicated for old coal sites. Repurposing plants of different sizes, locations, ages, and technologies requires a high degree of customization. It would be useful to map the workable combination of PV/biomass/wind, battery size which would complement the generation, and the usage of the existing turbo-generator system as a synchronous condenser that would fit in different categories of plants.

Thirdly, the social aspect of repurposing is just as important as the technical aspects. If the RE+FLEX centers can retain some of the employees and create new employment opportunities, it can be a potent option to reduce the social stress associated with plant/mine closure. Replacement with new generation has been discussed as the best among the other alternatives in the US, albeit in the context of conversion of coal plants to run on gas. However, with the cost of renewables and potentially batteries dropping rapidly, the demand for RE+FLEX centers could rapidly open up possibilities for employment retention as well as new jobs.

Finally, and perhaps most importantly, there will be a need to articulate a series of national and regional level strategies that align with renewable development and power system master planning. Without careful consideration of how to transition away from coal, there may be instances of grid failure or instability, which would quickly be blamed on renewables. We have seen such a story unfold in South Australia in 2017 that culminated into the world's largest battery being installed. It turned out to be a good development, but possibly not the optimal or least-cost choice. If a similar lack of planning and foresight occurs in China or India—the impacts would be far greater due to the sheer size of these systems. It could have huge negative consequences, potentially derailing the process of decarbonization.

We should therefore put our collective minds to:

- Take stock of regional and national coal retirement strategies, and develop a database of prospective candidate coal plants that have been retired or are about to be retired for re-purposing;

- Come up with a design of replacement RE, batteries, and synchronous condensers that could fit each of these plants;

- Develop a dialogue on the social and environmental issues;

- Undertake a cost-benefit analysis of the design for top 1-2 plants to establish a business case; and

- Turn it into an investment project.

It is up to us to lead the global conversation on repurposing coal mines and plants with matchless technical assistance and insightful dialogue on key satellite issues. Will you be a thought leader in the changing world of coal? Let us know your thoughts in the comments below!

References

Jordan, B. Lange, I., and Linn, J.. Coal Demand, Market Forces, and US Coal Mine Closures. 2018. Working Papers 2018-01. Colorado School of Mines, Division of Economics and Business.

Raimi, D. 2017, October. Decommissioning US Power Plants: Costs, Decisions and Key Issues, Resources for the Future.

Slattery, C.R. and Fogerty, J.M. 2015. Synchronous Condenser Conversions at First Energy Eastlake Plant, CIGRE US National Committee Grid of the Future Forum.

Waller, J. 2018. Managing the Coal Capital Transition: Collaborative Opportunities for Asset Owners, Policymakers, and Environmental Advocates. Rocky Mountain Institute. http://www.rmi.org/insight/managing-coal-capital-transition/

World Bank. 2018, November. Managing Coal Mine Closure: Achieving a Just Transition for All.